What is Lean Banking?

Lean operations, as a concept, is a process analysis and improvement approach that aims at uncovering the bank’s ineffective, non-streamlined, and bottle-neck processes, and employing improvement tactics to decrease or eliminate these areas of the activity. This should result in decrease operational costs, increase in revenue, higher client retention and more.

In banks, specifically, the implementation of “lean banking” usually means analysing the bank’s processes (branches, middle and back offices, headquarters etc.), and implementing improvements in the following areas:

- Processes and areas of “operational” work that can be done elsewhere (i.e. not in the presence of the client).

- Locating areas where a task is performed by overqualified/overpriced staff.

- Locating more automation opportunities (replace the human with a machine).

- Locating selling and upselling/cross selling opportunities to turn a service process into a revenue generator.

- Locating “easy wins” that can be achieved with zero-to-little IT developments.

- Locating double tasks and other resource inefficiencies.

- Locating ineffective use of information.

- Locating tasks that should be centralised.

- Locating tasks that should be de-centralised.

- And more

All the above are examples of improvement that can be made to the bank’s processes, and on a large scale can and do tilt the odds in the bank’s favour. The bigger the bank, the bigger the effect. Many banks who went through a Lean implementation report a %20 decrease in operational costs, and a revenue increase of %10-%15. This kind of improvement can go a long way to improve the bank’s ability to compete and stay profitable in today’s highly competitive environment.

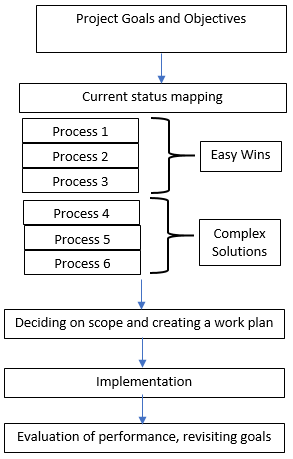

Let’s have a look at the typical steps of a Lean Banking project.

Step 1 – Setting Goals

For some reason, some organisations skip this step, which is a grave mistake. Goals must be set before embarking on the journey. The goals should be clear and measurable, and can be based on existing KPI’s the bank already tracks, but it is important to have specific goals that can be related to the Lean Banking project. This way we can see if the Lean project was worthwhile and had a good ROI. Some examples for Goals:

- Time it takes to onboard a new client.

- Number and value of loans issued by self-service channels

- Number of upsells offered and taken by clients

- The percentage of time “wasted” on operational actions out of the overall process (analysed separately for every process)

- Error percentage in an improved process

Step 2 – Current Status Mapping

The current status mapping is an important initial step, and will help us learn where to focus our efforts, and get maximum effect. The current status mapping may be structured like this:

- The most in-demand client facing processes in the branch – map out the processes to its smallest elements, and locate areas inefficiency, such as:

- Processes could take place in an automated channel instead of human interaction (the entire process or certain elements)

- Unnecessary operational work

- Double data entry

- Missed sales opportunities

- Time wasting on waiting for approval

- Analyse how the branch workers spent their time. How much of that time is spent on low-value work like paperwork/filing orders, and how much on high value activities such as offering value upsells for client?

- Analyse date obtaining and flow (while staying GDPR compliant). What is the error rate, and where in the process is most of the errors created?

- The current SLA (service level agreement) between the various departments in the bank, and between the bank and clients. In some cases, the current SLA may be changed. For example, the bank’s call centre may be answering the client’s incoming call within 30 seconds on average. This can be lowered to 90 seconds and create huge savings, while most clients will not mind the extra wait.

After completing and exhaustive mapping of the current status as demonstrated above, we are ready to move on the next stage.

Step 3 – Process Analysis and creating a work plan

Once we hold detailed mapping of the current state of the bank’s processes, we will start to have ideas on how to improve them towards meeting our goals. Some examples for ideas:

- Take out all the paperwork from processes like account opening, establishing a loan/line of credit etc., and moving the paperwork to a back office. It seems obvious, but many banks still so the paperwork in front of the client.

- Diverting a considerable percentage of the bank’s services to automated channels. Some banks have implemented this into an extent of almost completely eliminating their tellers. With the rise of AI technology, an even larger portion of banking services can be done by a machine. This can be done at the beginning of the process, or mid-process, in some cases.

- Many banking activities require a real-time authorisation of a senior member of staff. Further analysis may point out that some activities can be completed without real time authorisation (next day reports are good enough, as risk is manageable). Removing real time authorisation will help streamline the process and lower wasted time of senior staff.

Deciding on the scope and time line will determines what gets done and implemented. As resources are limited in most organisations, it’s a good idea to examine the benefit each implementation will bring, and to build a prioritisation scale. Some of these will be “easy wins” that are cheap, fast and easy. Others will require more time, effort and resources (such as IT development, organisational change etc.). These should be considered with respect to the benefit they bring, and situated in the prioritisation scale. After finalising our work plan and approving it with management, we can move forward to implementation.

Step 4 – Implementation

What follows right after deciding on scope, is the actual implementation. This can be generally divided into two groups:

- The easy to implement bits, that may include things like: simple changes of procedure, manual process changes, software adjustment etc.

- The more complex implementations will include – IT developments and implementation, changes of process, closing down departments and moving personal within the bank, and more.

While most banks will want to benefit from both forms of implementation, it Is usually advised to start with the fast and easy to implement bits, as they will bring easy wins and the project will start showing some initial ROI.

Step 5 – Results Analysis

As we further our implementation of the various elements of the Lean Banking plan, it is important to show the improvement of the bank in different, measured factors that were decided upon at the beginning of the project. This way the bank’s management will be able to see the benefit of the project right from the beginning and will be continuously committed to the process.

Process Diagram: