The financial industry, like any other industry, is facing its own challenges, as new destructive technologies are challenging the day to day operations of banking facilities. With new technologies such as block chain technologies, peer to peer lending, new Bitcoin ICO’s being launched, the world is seeing a decentralized view of money, and how to source, and store it for value maintenance.

Current banking operations, in order to compete with these emerging technologies, must brace themselves for the challenges that lie ahead, by allowing themselves to operate as efficiently as possible. As the financial industry is now ten years past the recession, operational efficiency still remains an important aspect of sustaining profitability over time.

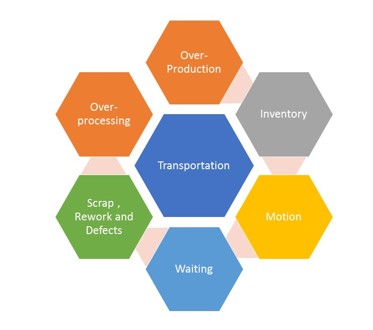

Applying the following Lean Principles, banks of all sizes can improve their organizational efficiencies. This discussion will be approached from the seven wastes Lean philosophies.

THE SEVEN WASTES

In an era where banking customers now have more choices that ever, it is important to an organization to ensure maximum efficiency in its operations. Any losses in service delivery can and will affect business profitability. The key to success therefore, is to minimize any wastage in the supply chain from supplier to customer, to facilitate this objective.

OVER-PRODUCTION

One of the tenets of Lean Operations is a Just-In-Time system which facilitates the minimum inventory in an ideal theoretical operation. Over-production occurs in instances where product generation exceeds product demand. The mortgage boom of the early 2000’s is an example of over production in the banking sector, which caused a market glut, followed by a crash. Excess system capacity was generated, but it did not have the appropriate backing to sustain the venture. In the event of a collapse, the market left many “empty” assets which affected the industry.

Over-production affected the banking industry’s inventory, and resulted in idle assets. From the banking perspective, you want to design a system that allows you to keep enough stock on hand, to carry you over during the rough periods. The bailouts saved the sector, but it took a while for recovery. For a banking facility to run smoothly most of the time, the inventory levels must be kept to a minimum.

INVENTORY

Inventory is a tally of the raw material progression through a process. Banking systems have extensive assets which add to their capital base as inventory, so the term is applicable to both services and products, as there is an item either physical or intangible that is being transformed via each stage. As banking transactions takes place, it is important to track the organization progress so that appropriate customer satisfaction, and asset management on the banks side, can be attained. Appropriate inventory management is ideal to ensure that excessive capital is not being tied up. Storage also has additional costs, and affects the banks liquidity and it is in the best interest of the management to minimize these associated costs.

MOTION

Motion waste is brought about due to inefficient operations. The banking sector has managed to minimize this waste to a science. Via assessing the best way to optimize customer waiting times via the queuing theory, along with the advent of online banking and trading, the motion wastes associated with banking are somewhat alleviated.

TRANSPORTATION

The supply chain is a critical component to sustaining operational efficiency. One way to minimize this waste is to keep all the unit operations in close proximity to each other, as well as in sequential order so that no steps are re-traced. The banks can optimize their supply chains where their critical product inventory is concerned. This includes stationary, and other products used in their operations.

OVER-PROCESSING

Exceeding customer expectations beyond economic feasibility is a waste. As much as it is in our best interest to satisfy customer needs, the organization needs to protect itself from this. The best operational standard to uphold, is to use the minimum resources to satisfy the requirements of the customer. Appropriate process optimization strategies will minimize this waste.

SCRAP, REWORK AND DEFECTS

If a banking product does not meet customer specification, it is either scrapped, reworked or deemed as ineffective. Built in process quality controls along the process, or blending where necessary, can help to alleviate this outcome.

Minimizing the aforementioned process wastes, will enable your banking organization to operate from a leaner perspective, and allow for more competitive and profitable operation.